Boring Trading Strategies:

Nice during crazy times

In February 2018, Collective2 had a near-death experience. At that time, some of the most popular trading strategies on Collective2 traded “volatility.” To be exact, these strategies bet that volatility would go down, or remain low.

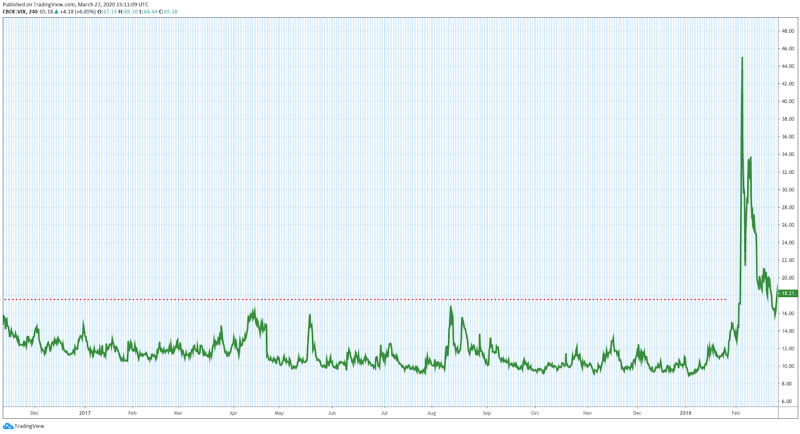

But in February of that year, volatility exploded upward. Here is a chart showing how “volatility” behaved at the beginning of 2018:

Many of the popular strategies on Collective2 blew up, and a lot of investors lost money.

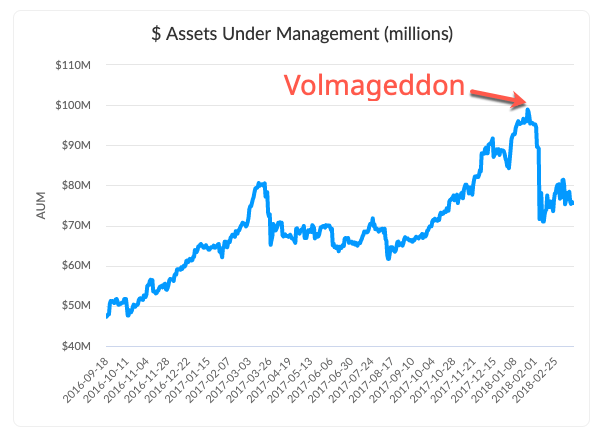

Here is a chart showing Collective2’s “assets under management” for the time period in question:

“Volmageddon” (as the financial industry came to call the February 2018 explosion in volatility) was a wake-up call for Collective2.

Until that time, Collective2 considered itself an open platform. We allowed anyone in the world to post a trading strategy on our site. We monitored these strategies, and reported their results in real time; and we allowed investors to replicate these trading strategies inside their own brokerage accounts. We called Collective2 “the world’s first distributed hedge fund” — and, if you can get over that whiff of Silicon Valley self-promotion, there was a lot of reality beneath the claim. Basically, we said to people: “Rather than tying up your capital with one New York hedge fund manager who runs a secretive black box, and who won’t always give your money back when you ask for it, and whose performance will decline as he gathers more assets, why not create your own personal hedge fund by replicating the strategies of several ‘emerging’ hedge fund managers — that is, people who do not necessarily live in New York; who do not work at Goldman; who did not go to Harvard. Oh, and by the way, your money never leaves your own brokerage account. You just use Collective2’s magic software to replicate the trades of various trading strategies inside your brokerage account. You can pull the plug any time. No need to ‘ask for your money back.’”

It was a pretty compelling sales pitch, and it helped C2 aggregate nearly $100 million dollars of assets under management by the beginning of 2018. Now, remember, no one handed their money to Collective2, and there was never $100 million sitting in our brokerage or bank account. Rather, hundreds of customers “attached” their individual brokerage accounts to our software, and chose to follow some of the trading strategies that were available on our platform. In aggregate, these customers risked about $100 million dollars.

And, boy did they risk it. As the chart above demonstrates, Volmageddon caused about $30 million dollars to “leave” Collective2 in a hurry.

“Leave” is an anodyne word that fails to convey real human stories, and real human pain. Some of that $30 million represents customers who lost money due to the strategies they chose to follow; some of that was customers who didn’t necessarily lose money but who saw things they didn’t like, and so pulled the plug on their Collective2 experiment.

The hard thing about Volmageddon, and other incidents that cost customers money, is that they are not, strictly speaking, Collective2’s “fault.” After all, we don’t choose which strategies our customers trade. Customers make their own decisions! Remember how we call ourselves an “open platform?” Well, before Volmageddon, we really drank our own Kool Aid. There are thousands of strategies tracked on the Collective2 platform, and we assume customers can use their own talent and smarts to evaluate the track records of these strategies and make wise decisions. (For the statistically-oriented investor, the level of detail available on Collective2 is astounding. Prospective investors can even drill down into individual trades within a strategy track record, and can see the real prices received in individual real-life brokerage accounts that follow a strategy — anonymized to protect privacy, of course.)

So in theory customers knew exactly the risks they were taking when they signed up to trade a strategy that, for example, bet volatility would remain low.

When customers lost money due to Volmageddon, or other market downturns, our temptation at Collective2 was to throw up our hands and say, “Well, tough luck, kid. Sorry you chose such risky, stinky strategies.”

And for the longest time, that’s more or less what we did. Well, without the “tough luck, kid” part… and with suitably lawyer-vetted boilerplate attached to our emails. But the message was the same: You chose the strategies; we’re just a open platform; and you can choose any kind of strategy you want — good or bad. Sure looks like you chose… bad.

Except, the problem was: that felt yucky. And also: it made for a really crappy business model.

Because as anyone in the financial industry will tell you, the expensive part of running a fintech business ain’t the electricity for the computers, or even the salaries for the computer programmers. The expensive part is finding the goddamn customers. Every single customer that signs up at Collective2 costs us a tremendous amount of money to acquire. (While we can’t tell you exactly what the number is, we’ll guide you like this: choose a customer acquisition cost (CAC) number that sounds sufficiently, ridiculously high. Then multiply it by 10x. That’s how much it costs.)

So the policy of: spend a lot of money to acquire customers, and then just let them make crazy-ass decisions and blow up their own trading accounts, and then tell them, “Sorry, you chose to make a crazy-ass decision” … well, as a business strategy, it isn’t optimal.

On the other hand, the magic of Collective2 — the thing that makes it really compelling to a lot of investors — is that you can choose your own customized solution. And some people like high-risk strategies from completely unknown strategy managers. After all, sometimes “high risk” can mean “high reward.” (Not always, obviously!)

So while it didn’t feel right to encourage Wild West gun-slinging trading, it also didn’t feel right to completely “lock down” Collective2 and restrict people’s choices entirely. A lot of people want to be able to choose any strategy they please, thank you very much. And who are we to say they are wrong?

That’s when I had an idea. What if we told strategy managers, “You can run any strategy that you like on Collective2. However, if you agree to trade within certain tight risk-control parameters, we’ll guarantee you a minimum income. And also, we’ll lower our fees to you, and also we’ll give your strategy extra promotion on the Collective2 platform.”

Thus was born “C2Star Certification.” To participate, a strategy manager pays a small entry fee (so that they have some skin in the game), and they agree to run their trading strategy on Collective2 according to very strict parameters. If they comply with these restrictions, we guarantee that they’ll earn $1,000 per month minimum on C2. (Okay, before you pummel me with snarky comments, let me stress: that’s the minimum. Good strategies can earn a lot more than that as they attract investors who replicate the strategy inside brokerage accounts.) The idea of guaranteeing a decent minimum earnings threshold to strategy developers was something completely new for Collective2.

And frankly, we had no idea what would happen. Would we go bankrupt as 10,000 great strategies piled onto our platform? Or would no one show up? Or would our risk-control restrictions be so strict that no one could qualify for C2Star Certification?

Collective2 has an active user forum, where our members have passionate opinions, and don’t mind sharing them. Often those opinions boil down to: “Matthew, you are stupid.” Or, “Matthew, you are trying to deceive us like some kind of James-Bond super villain hiding inside a volcano.”

When we launched C2Star, many passionate Collective2 users had typically passionate opinions. Like these, posted on our public forums:

You get the idea! The response from the vocal members C2 community fell into three buckets:

1) The criteria to be certified as a C2Star strategy are just too hard; no strategy will achieve it (for long). The program will fail.

2) The criteria to become certified require that traders to try to decrease risk. This means there will be lower returns, and no one comes to Collective2 for lower returns. The program will fail.

3) The program is just a cynical scheme in which Collective2 takes advantage of trading-strategy developers and collects program entry fees, without offering any realistic hope that they will earn money in the long term. The program will fail.

Now, in fairness, most of the people that posted these messages were themselves strategy managers on Collective2 — not investors — and there are all sorts of reasons a strategy manager might not like the C2Star program. Some managers traded successfully in a style that would not meet the program’s requirements. Others didn’t trade successfully at all. In either case, C2Star certification program could be viewed as a risk to these managers.

Here’s the way this story is supposed to end. Despite all the naysayers, the C2Star program proved to be an obvious success. Thousands of trading-strategy managers applied for C2Star, hundreds achieved certification, and hundreds of investors — that is, people that chose strategies to replicate inside their personal brokerage accounts — chose only C2Star strategies, thereby concentrating investor capital in strategies less likely to blow up, thereby decreasing the risk of the next Volmageddon. (Let me repeat my general caveat again: “less likely to blow up” does not mean guaranteed to not blow up!)

That didn’t happen. For many months, the C2Star program was merely a modest, incremental success. We attracted a growing number of strategy managers who agreed to manage their trading strategy according to our strict risk controls. We attracted a growing number of investors who wanted to trade these strategies.

But the numbers, while growing each month, were nonetheless quite modest. Not thousands of strategies, certainly. Economically, the program was a manageable money-loser for Collective2. We paid out thousands of dollars more every month than we collected (so much for the program being a cynical ploy to reap entrance fees).

But I kept the program going, and considered it a good investment, because it assured us that Collective2 would always have a stable of well-managed conservative strategies available on our platform — even if investors did not flock to them.

And there was the rub. Making strategies available on the platform is not quite the same thing as forcing investors to use them. In fact, the reality was that most investors chose not to use C2Star strategies… even though we promoted the hell out of them.

On January 16 2020, I tweeted a lament that the most popular strategies on Collective2 (popular in the sense of most dollars of capital following them) were actually very lowly “ranked” according to our scoring methodology:

But it was worse than that. It wasn’t merely that investors flocked to lower-ranked strategies. The C2Star program never even cracked the Top Twenty! That is: out of the top-twenty most-followed strategies ranked according to AUM, not a single one was C2Star Certified… even though there were half dozen fully-certified strategies, and a dozen more in the process of being certified.

Notice the date of the tweet: January 16, 2020. This was approximately the time that reports had begun filtering out of China about a strange new virus spreading in the province of Wuhan.

When markets darkened, C2Star shined

Okay, another caveat. What I’m about to write will sound self-congratulatory and overly optimistic. I want to stress that nothing I write here is meant to convey that investing through Collective2s is low-risk, or that it is appropriate for everyone. Trading is generally risky. Trading at Collective2 is even more risky. You can lose money. Okay?

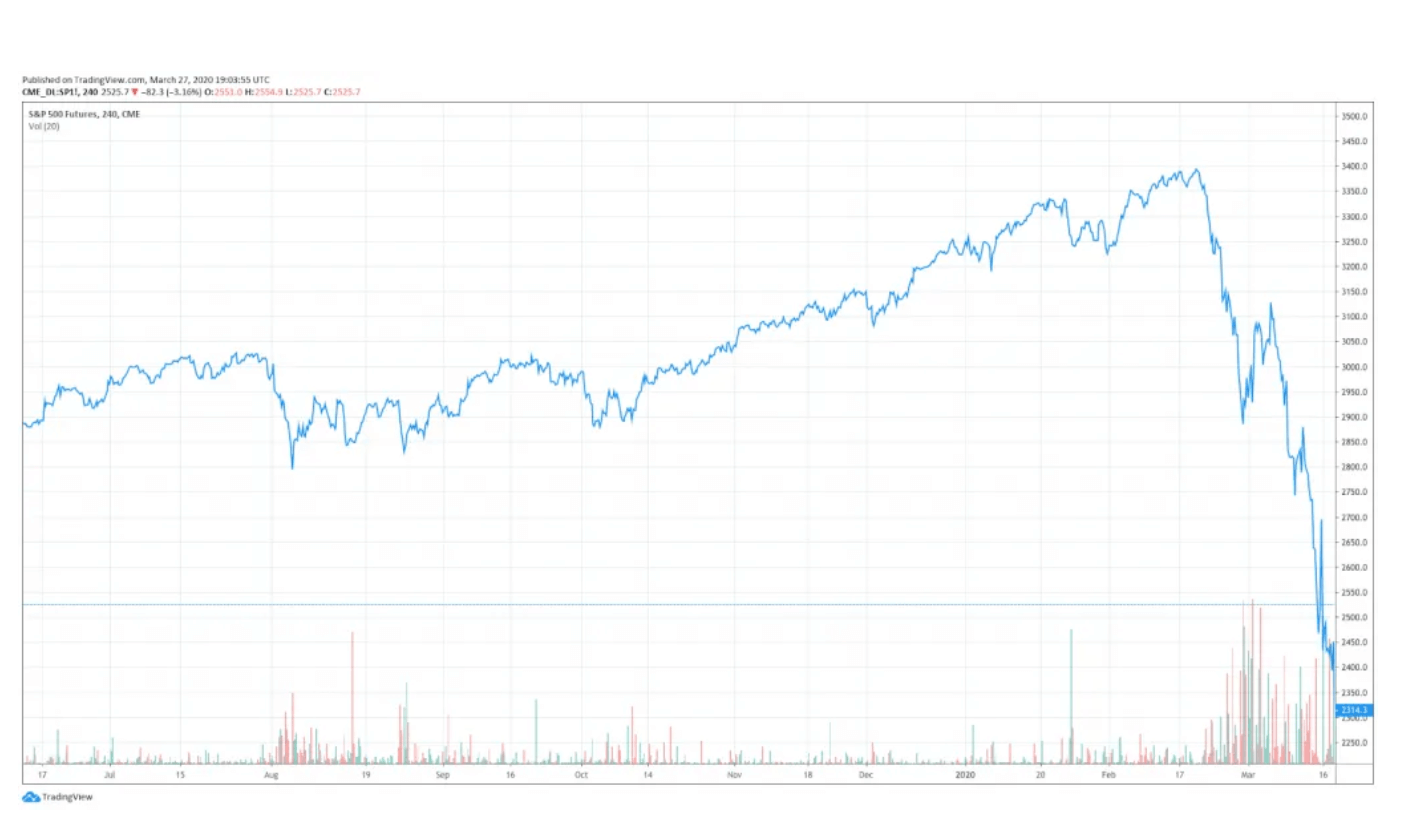

Now, on to my main point. Everyone knows what happened next. The stock market completely, utterly collapsed, at a speed and magnitude greater even than that of the stock market crash of 1929, which ushered in the Great Depression.

To refresh your memory, here is how the stock market treated buy-and-hold investors when the COVID-19 pandemic began to spread:

Ugly.

And how did those popular, high-risk Collective2 strategies do during the same period? Well, about the same as the stock market did, but that ain’t saying much.

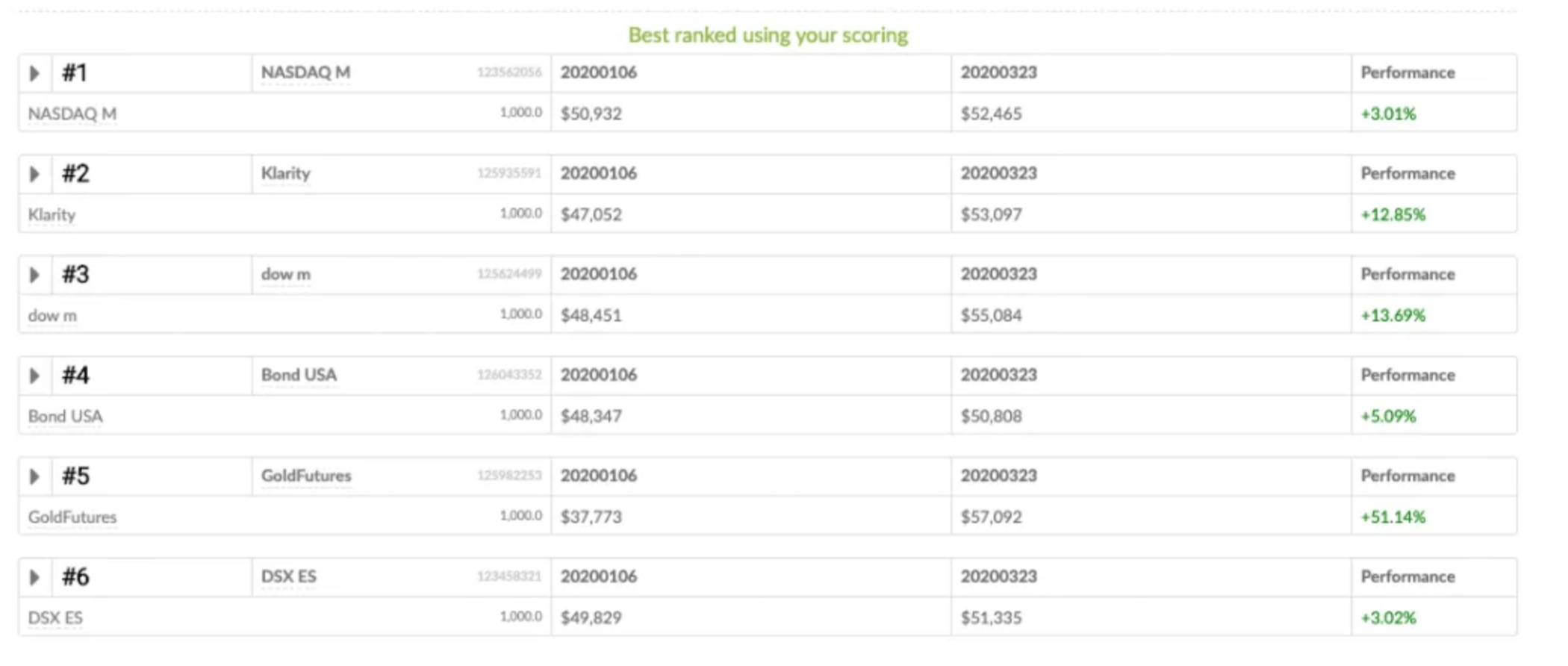

On the other hand, how did those boring C2Star strategies perform? Well, it turns out that there are times when boring strategies are nice to have around!

I have built a little “testing workbench” that allows me to see how Collective2 strategies hypothetically perform during arbitrary periods of time. I told my workbench: “Show me what would have happened if I had invested ONLY in the C2Star strategies that were ‘certified’ as of the beginning of the year (i.e. right before COVID). Assume I held on to that portfolio, no matter what happened, even after COVID decimated people and markets, until March 23 (when I ran the test).” Here is what my workbench shows:

Let me remind you again, at the risk of being tedious: the results above are completely hypothetical. They suffer from hindsight bias. No one actually traded that exact portfolio in real life. All the standard disclosures and caveats apply. In other words, don’t get too excited.

But still!

I can’t help but feeling that the C2Star program was vindicated to a small degree by the COVID market meltdown. C2Star did exactly what it was meant to do: it provided the Collective2 platform with a critical mass of strategies that did not blow up when the markets did.

I’m therefore happy to report to you (as I will report to my own investors in my monthly investor letter) that, while Collective2 have been affected by the market downturn (our AUM is down), things are not as dire as they could have been. The fact that C2Star strategies were available (even though they were not the most popular strategies on the platform, they were still used by many investors) mitigated the worst effects of the meltdown. And the fact that C2Star strategies are available, even after the meltdown, gives Collective2 users reason for cautious optimism.

Here are some resources for people interested in learning more about Collective2 and C2Star certification.

Here is a list of strategies currently participating in the C2Star program:

https://collective2.com/selector/c2star_certified

Here are the requirements for participating in the program: https://collective2.com/c2star/showRequirements

If you’re a strategy manager interested in signing up for the program, start here: https://trade.collective2.com/c2star/

Finally here is an important reminder about risks and about how results reported on Collective2 are hypothetical.

Past results are not necessarily indicative of future results.

These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

You may be interested to learn more technical details about how Collective2 calculates the hypothetical results you see on this web site.

The following are material assumptions used when calculating any hypothetical monthly results that appear on our web site.

There is a substantial risk of loss in futures and forex trading. Online trading of stocks and options is extremely risky. Assume you will lose money. Don’t trade with money you cannot afford to lose.