Percent profitable trades

This is the first article in the series “Performance metrics of trading strategies.” There will be a minimum of theory, a maximum of practice, and simple mathematics. And I’ll start with the percent profitable trades, or win rate.

One of the most common questions I am asked as a trader concerns the win rate of my trading strategies. And, frankly, this question always puzzles me. What value do you attach to this metric?

In this article, we will analyze this statistic — the “percent of profitable trades” — and consider how (and whether) to think about it.

Theory

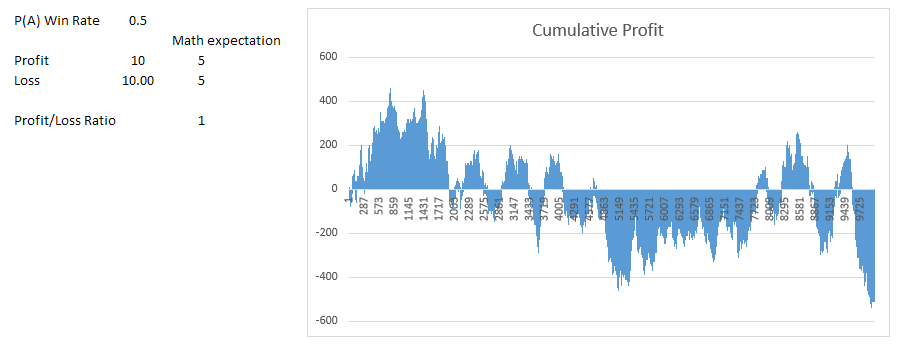

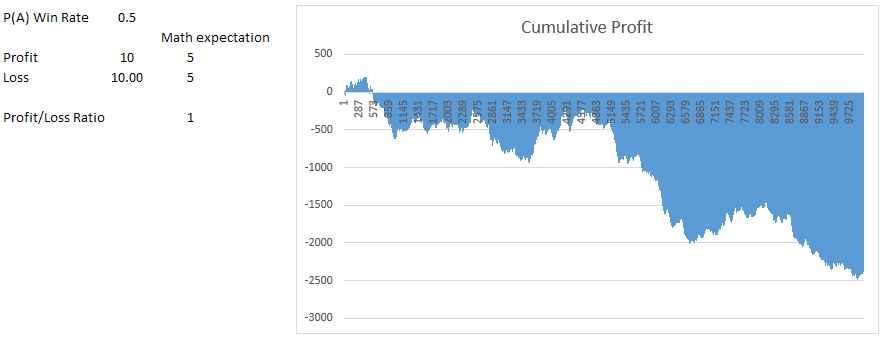

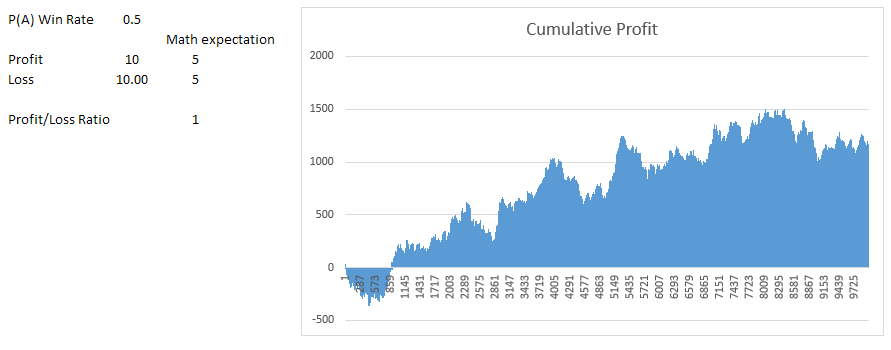

To start, let’s build a simple model with 10,000 random outcomes (trades).

Variable 1: Win rate, let’s call it P(WR).

Variable 2: Average profitable trade, let’s call it TP – take profit. (We can do without it, but for clarity, I prefer to use values that are close to real ones.)

The conditions are:

- Each of the 10,000 outcomes, independently of each other, randomly generates +1 with the set probability. If not +1, then -1. This is the trade’s result – positive/negative.

- If +1, then the trade’s result is equal to our TP (take profit).

- If -1, Since all outcomes in the model, are independent and random, the mathematical expectation (call it E) of such a “trade” will be equal to 0.

Hence, at -1, the size of the loss (call it SL) will be:SL = E(P(WR) * TP) / (1-P(WR))

Example 1

The win rate is 0.5. The profitable trade is $100.

This means a losing trade is (0.5 * 100) / (1 – 0.5) = $100.

The profit/loss ratio is 100/100 = 1.

Data generation 1

Data generation 2

Data generation 3

Example 2

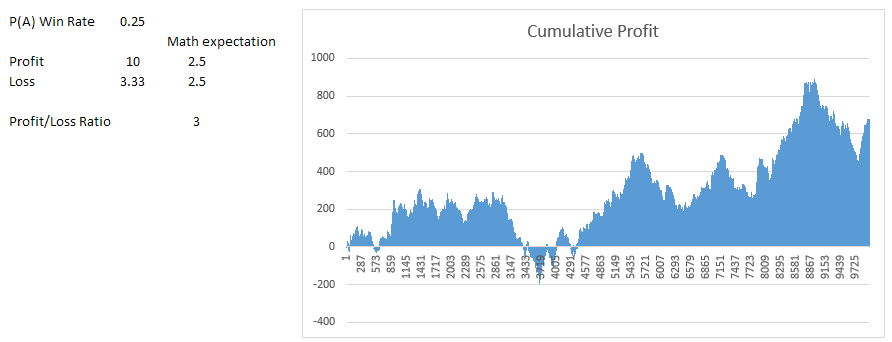

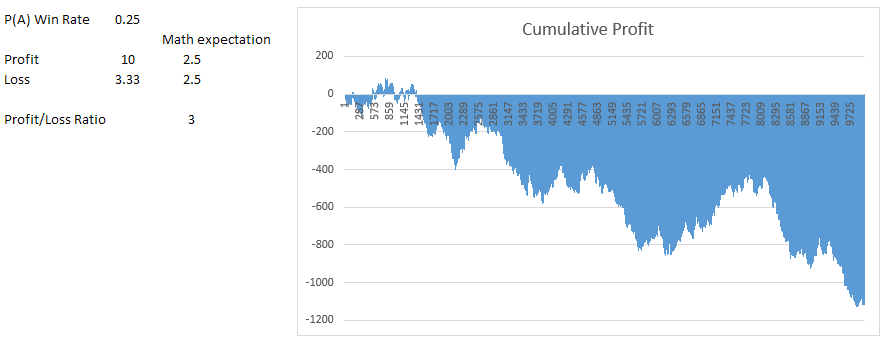

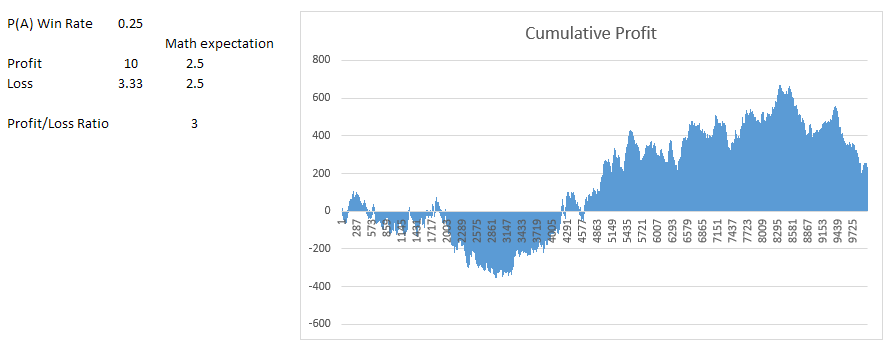

The win rate is 0.25.

The profitable trade is $100.

This means a losing trade is (0.25 * 100) / (1 – 0.25) = $33.33.

The profit/loss ratio is 100/33.33 = 3.

Data generation 1

Data generation 2

Data generation 3

Example 3

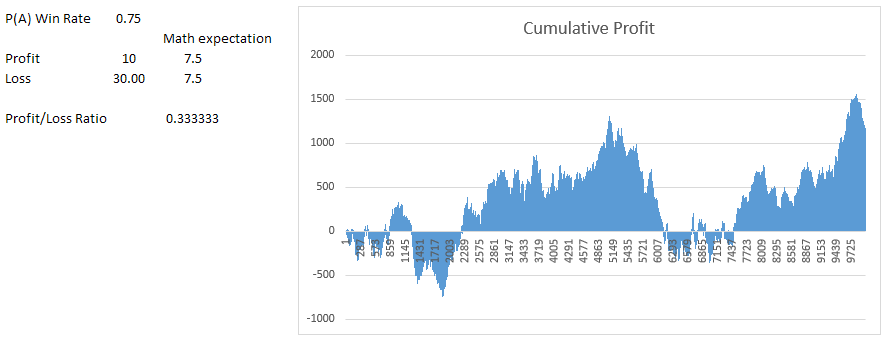

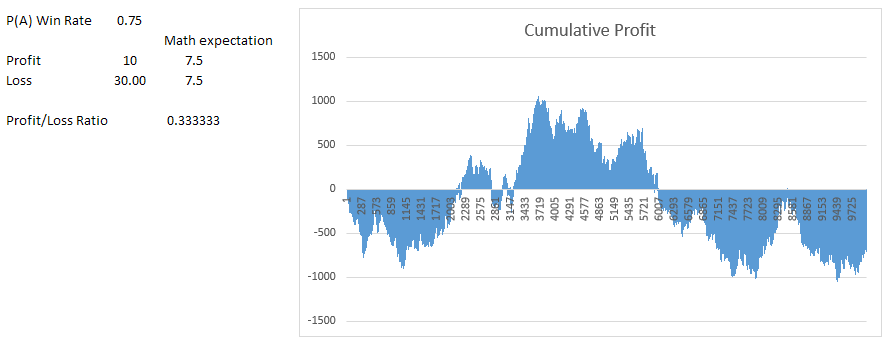

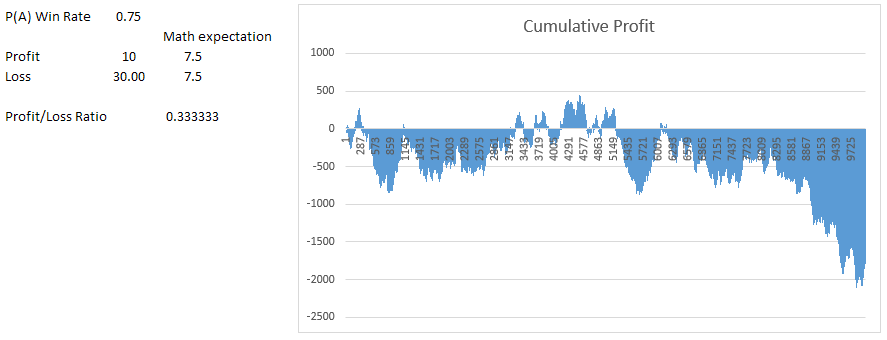

The winrate is 0.75.

The profitable trade is $100.

This means a losing trade is (0.75 * 100) / (1 – 0.75) = $300.

The profit/loss ratio is 100/300 = 0.33.

Data generation 1

Data generation 2

Data generation 3

Practice

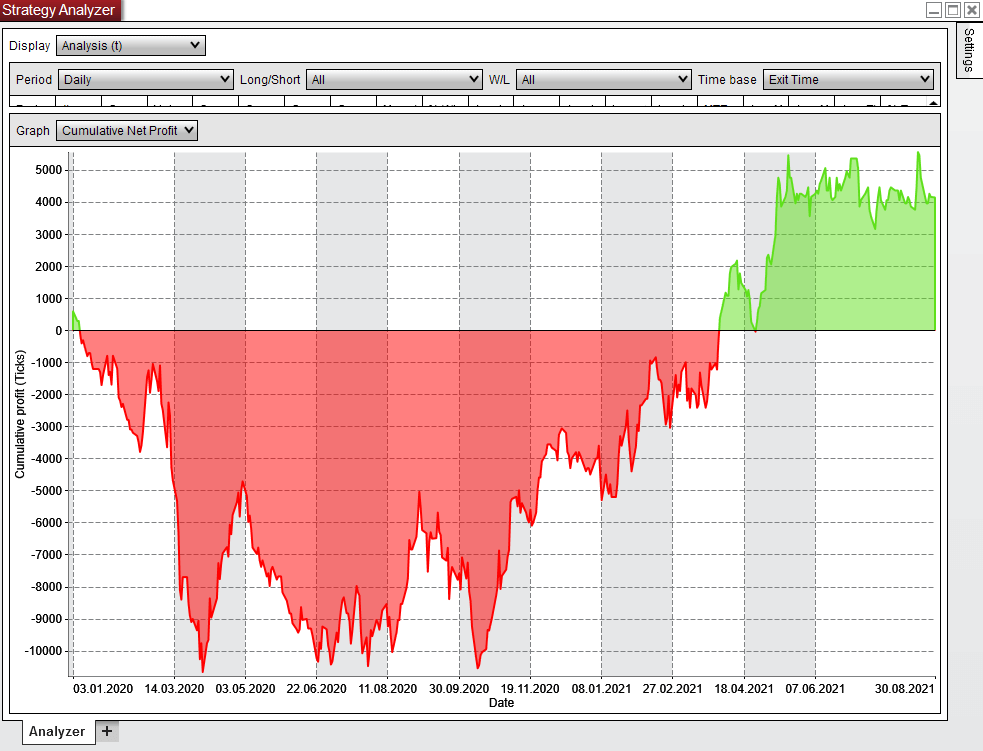

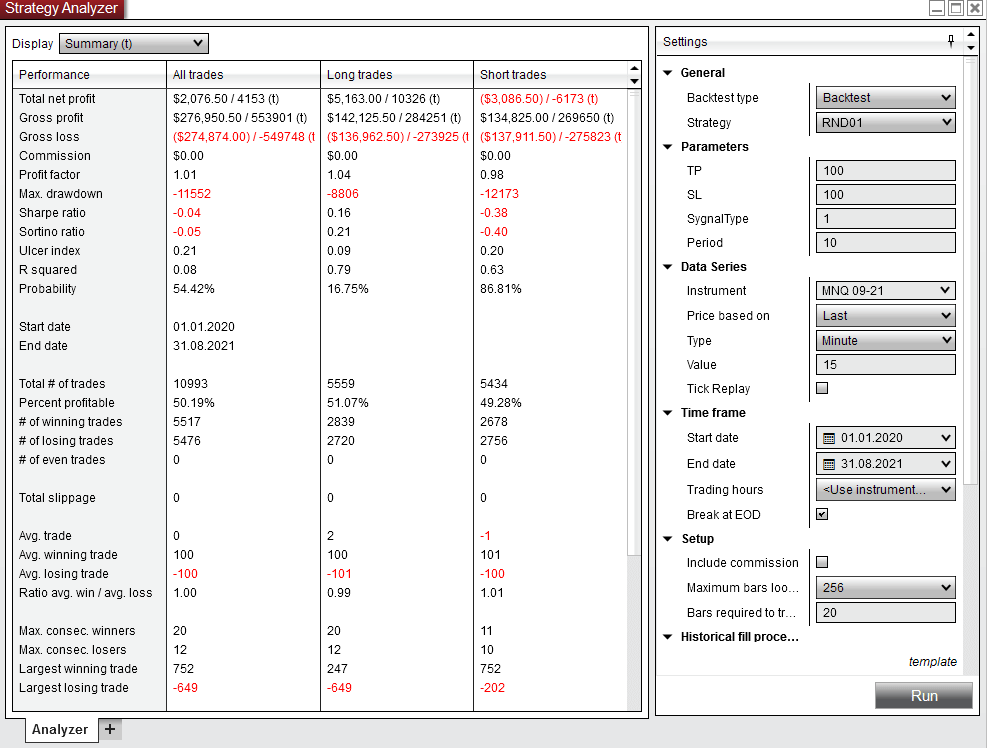

Let’s replicate this theoretical model on real market data.

For testing, I will use the NinjaTrader 8 trading platform.

Strategy Condition:

Instrument: MNQ

Period: 01/01/2020 – 08/31/2021

Data series: 15 minutes

Parameters:

TP – take profit

SL – stop loss

Entry Condition:

- There are no open positions.

- Generates random value from 0 to 1.

- If 1, then enter long.

- If 0, then the entry is short.

- Set take and stop orders.

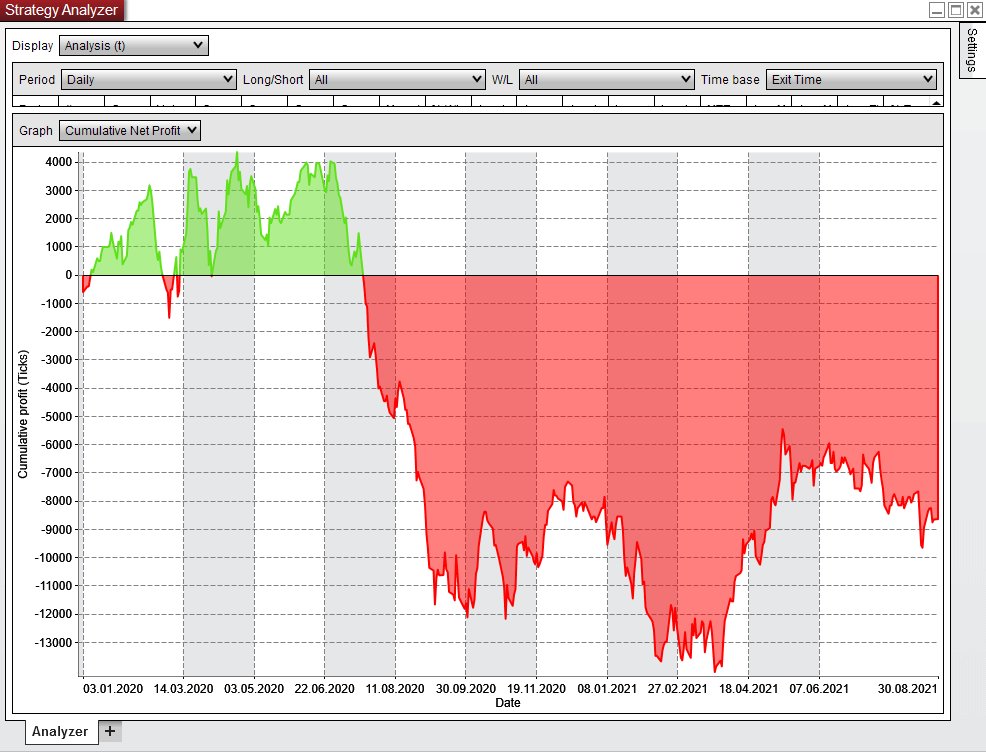

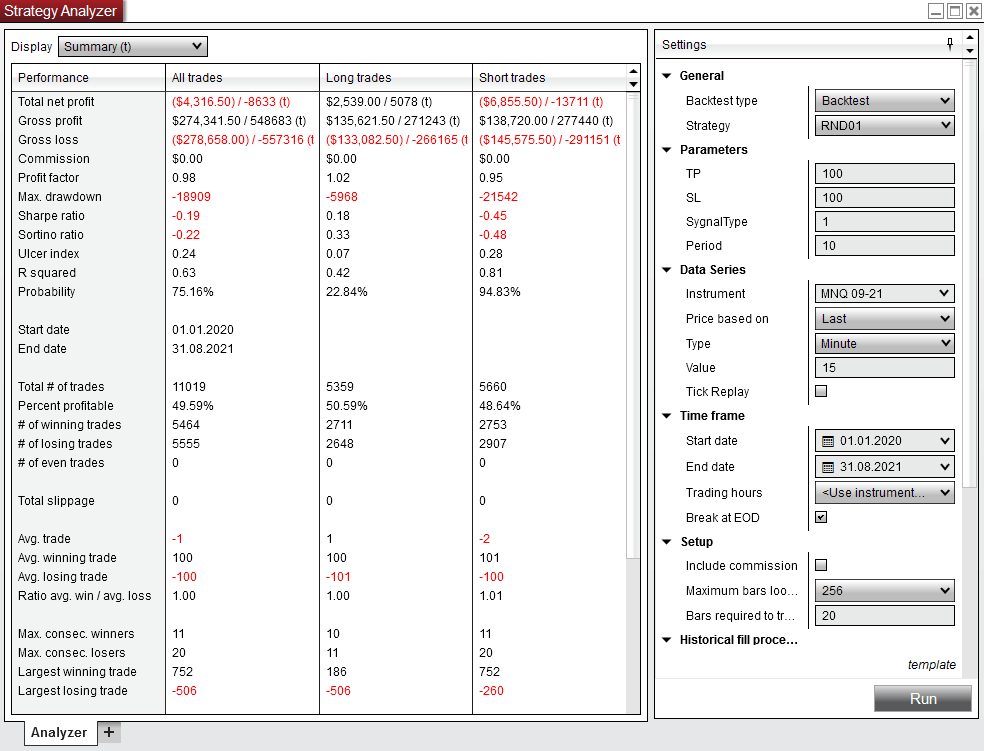

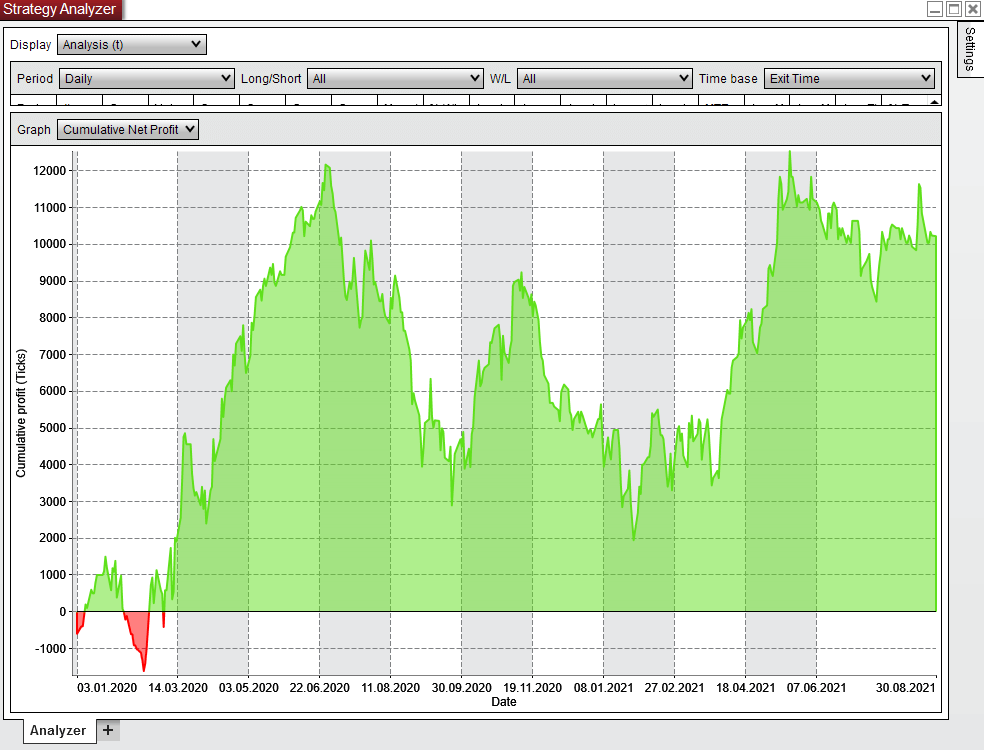

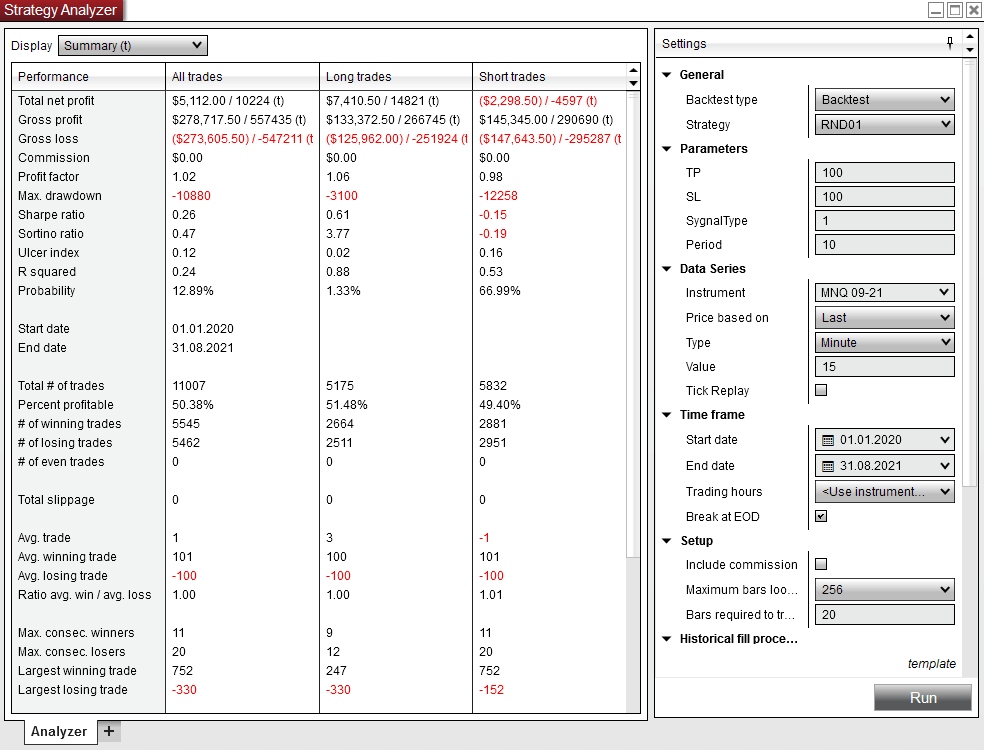

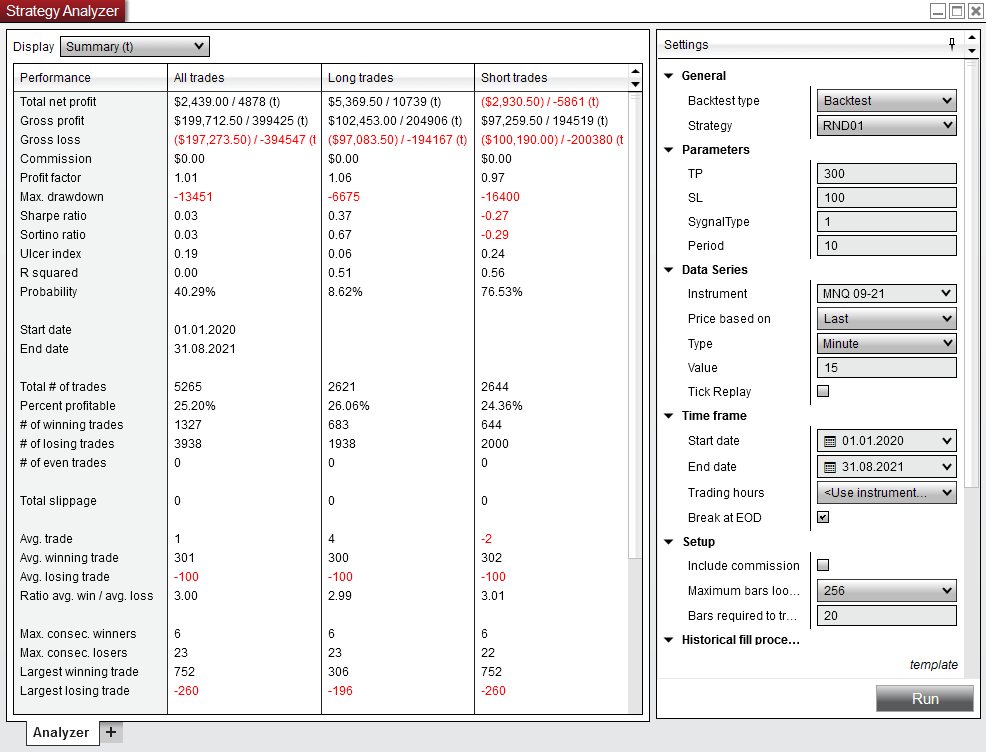

Test 1

TP = 100

SL = 100

TP/SL ratio = 1

Expected win rate(percent profitable) = 0.5

Data generation 1

Data generation 2

Data generation 3

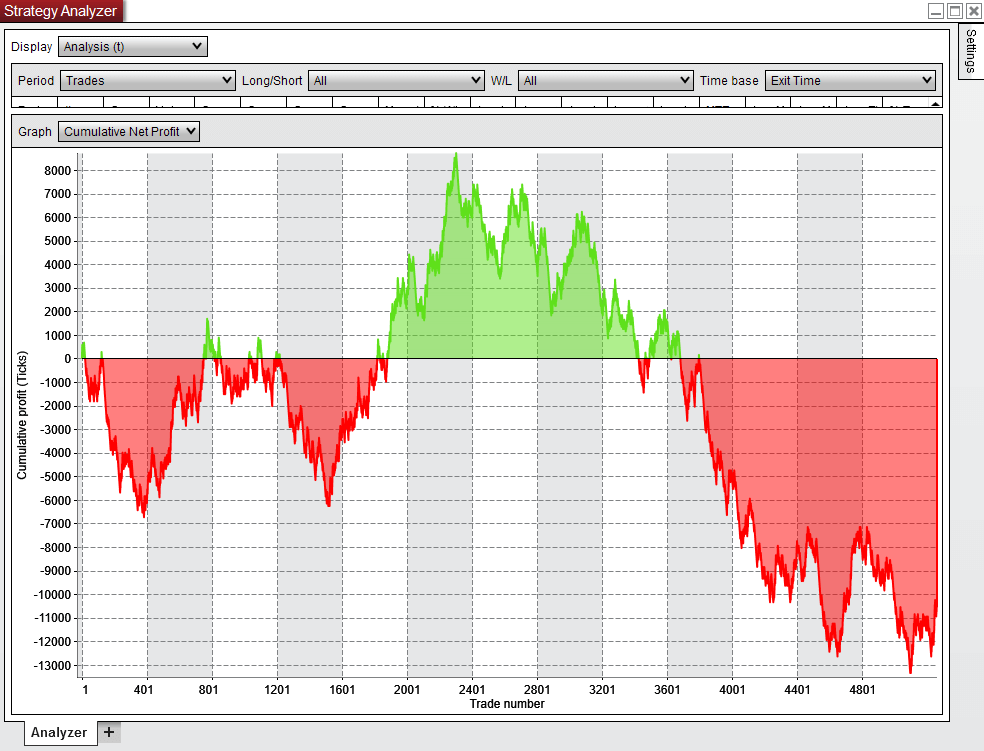

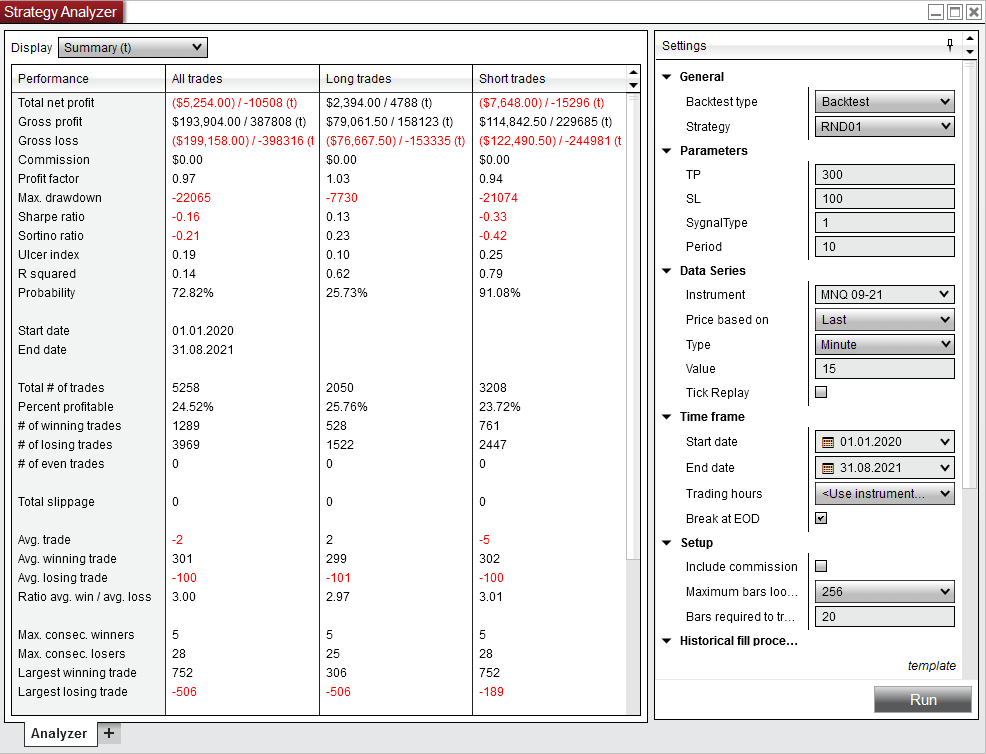

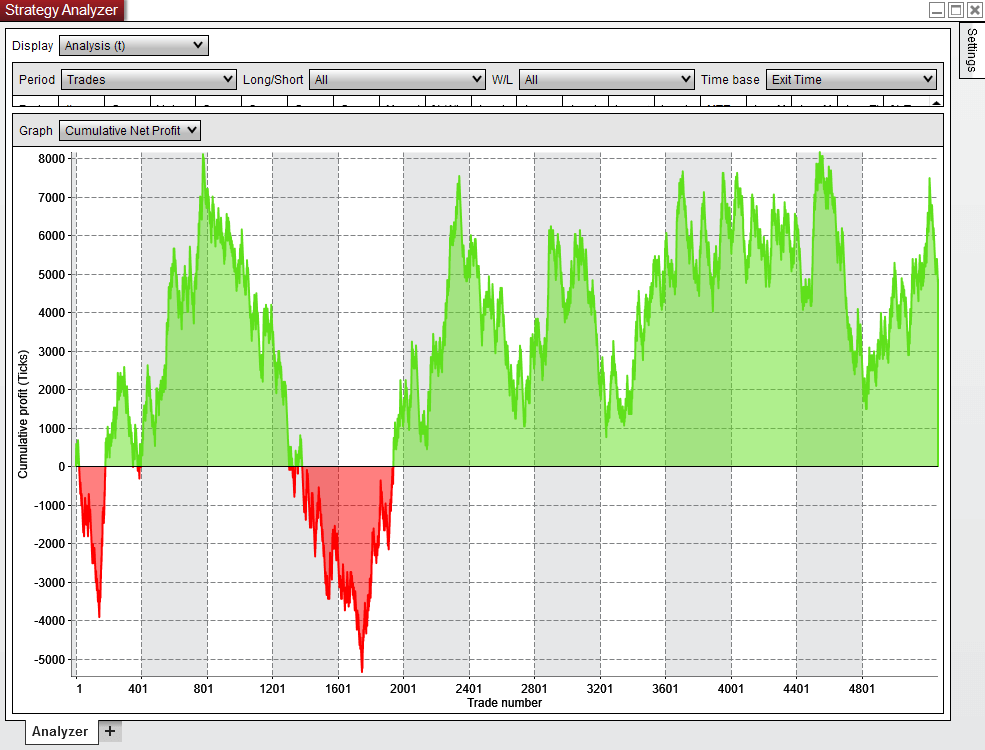

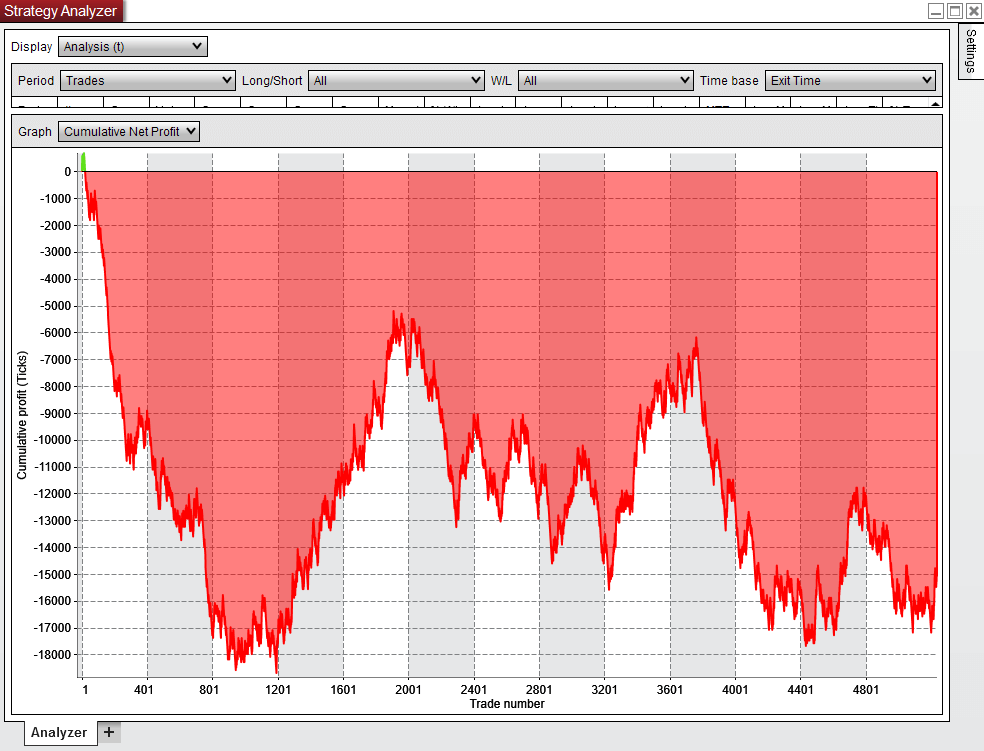

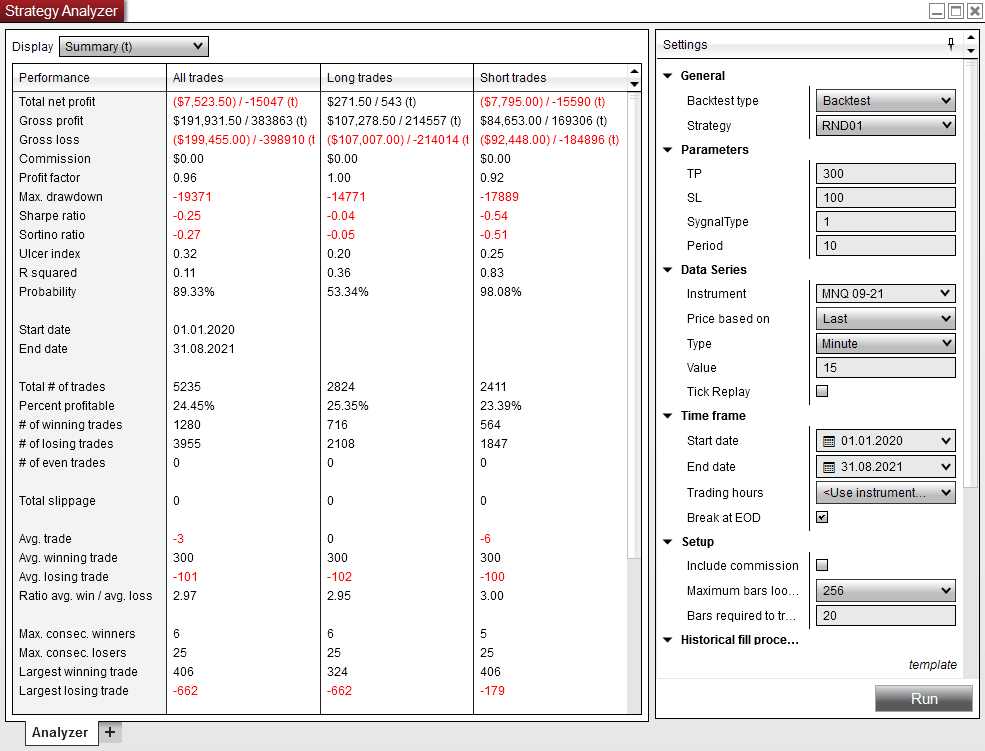

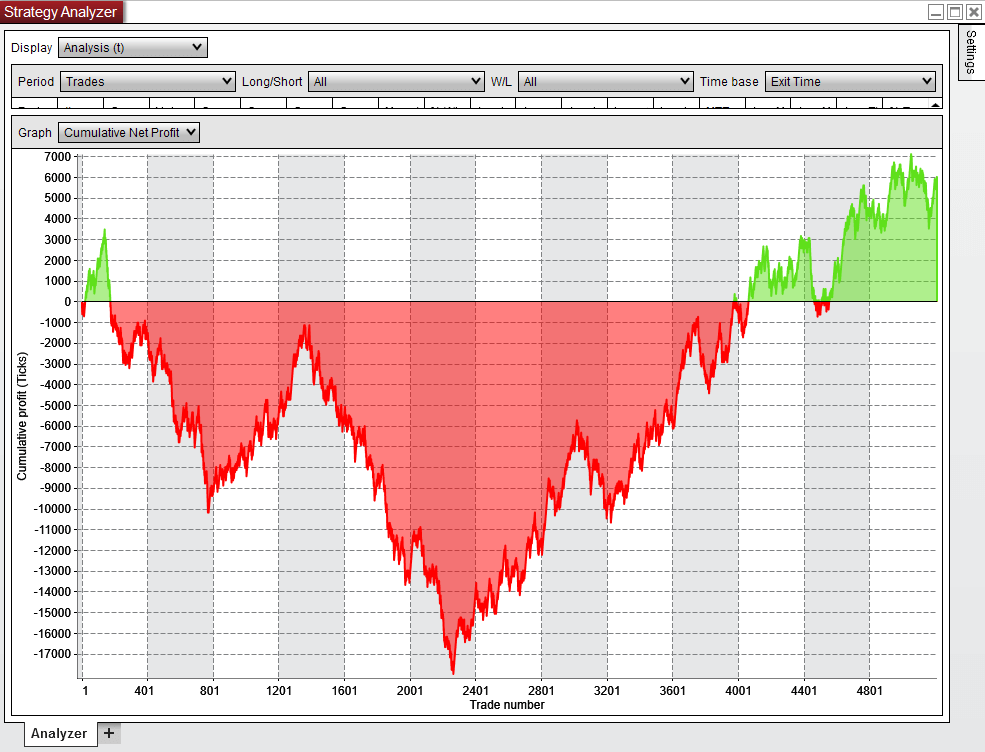

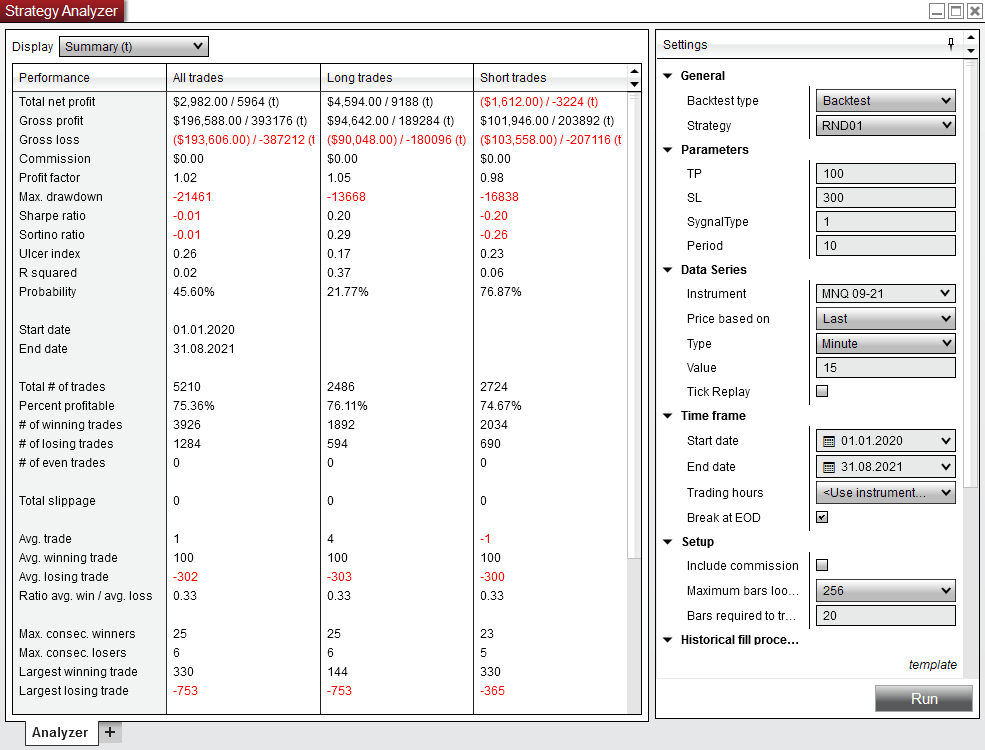

Test 2

TP = 300

SL = 100

TP/SL ratio = 3

Expected win rate(percent profitable) = 0.25

Data generation 1

Data generation 2

Data generation 3

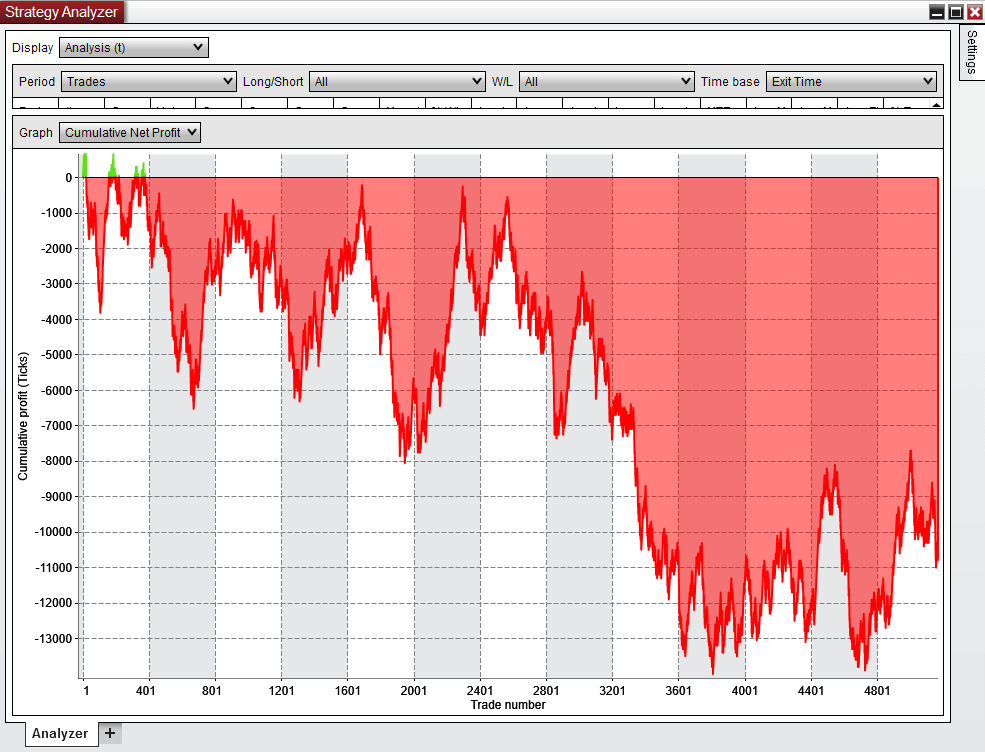

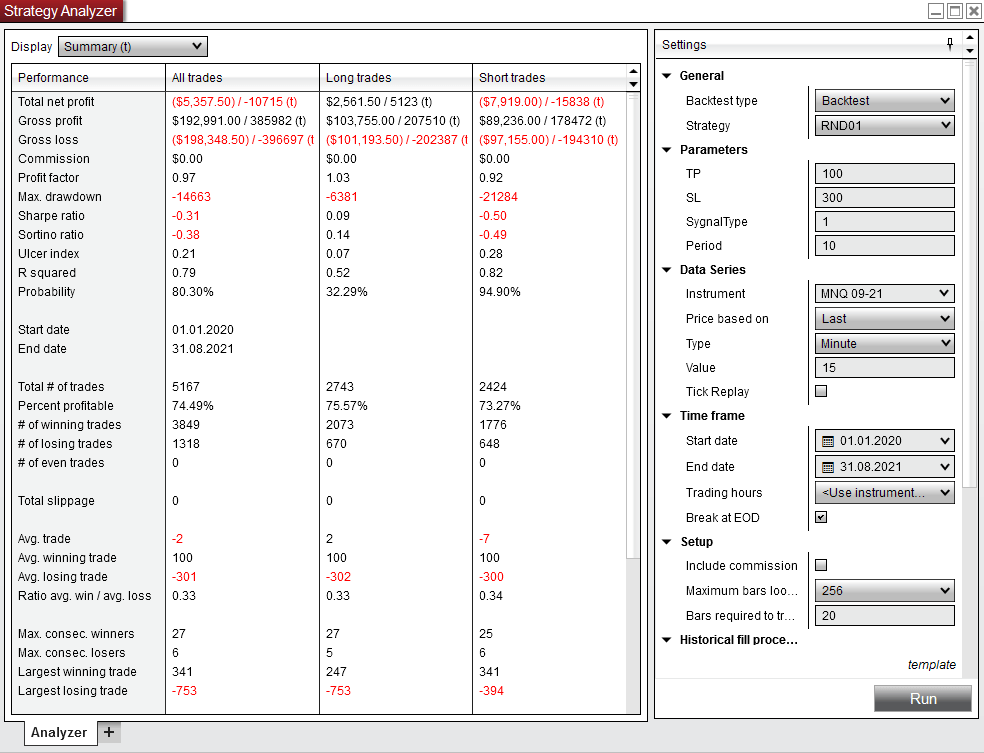

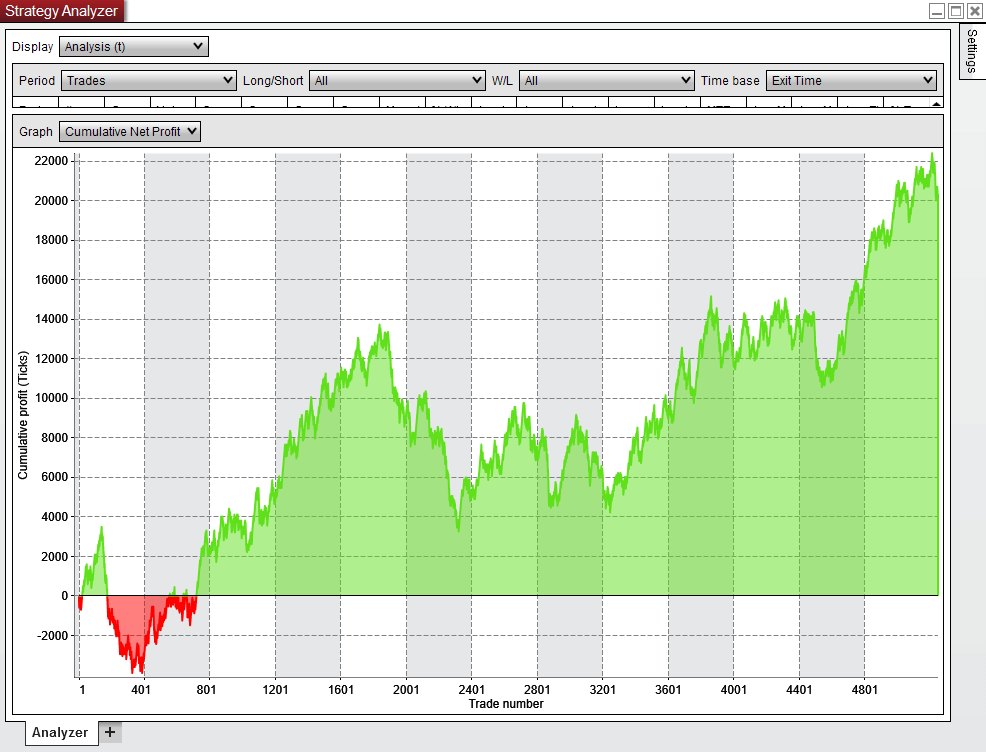

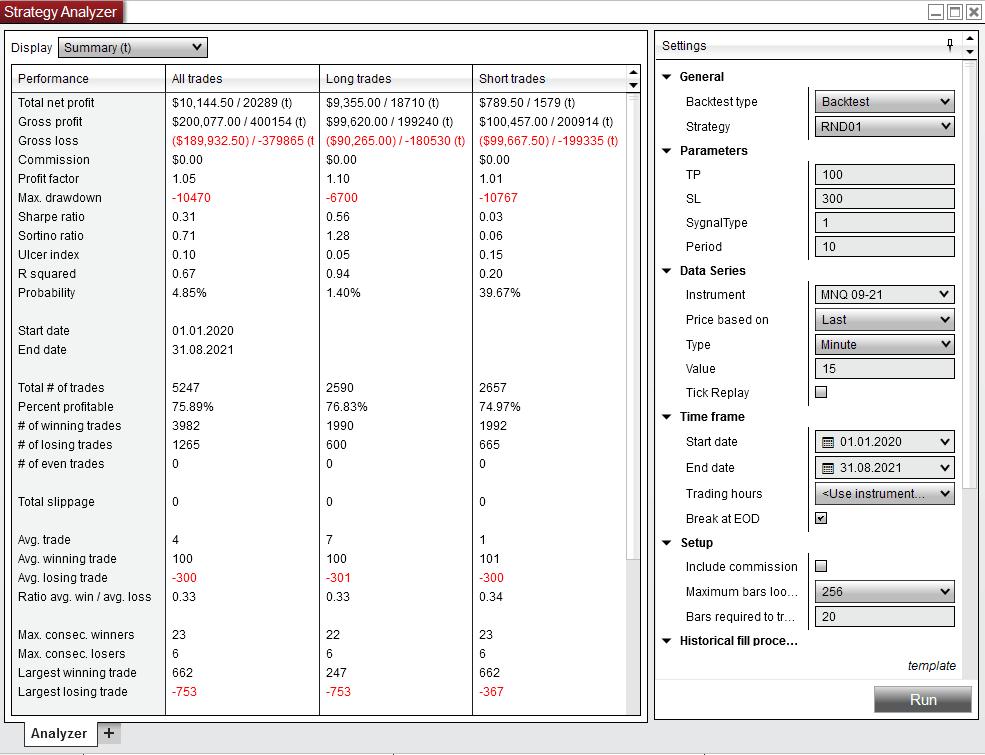

Test 3

TP = 100

SL = 300

TP/SL ratio = 0.33

Expected win rate(percent profitable) = 0.75

Data generation 1

Data generation 2

Data generation 3

Results are as expected. We can say that the test confirms the theoretical model. By moving the profit/loss ratio, you can achieve any value of the win rate.

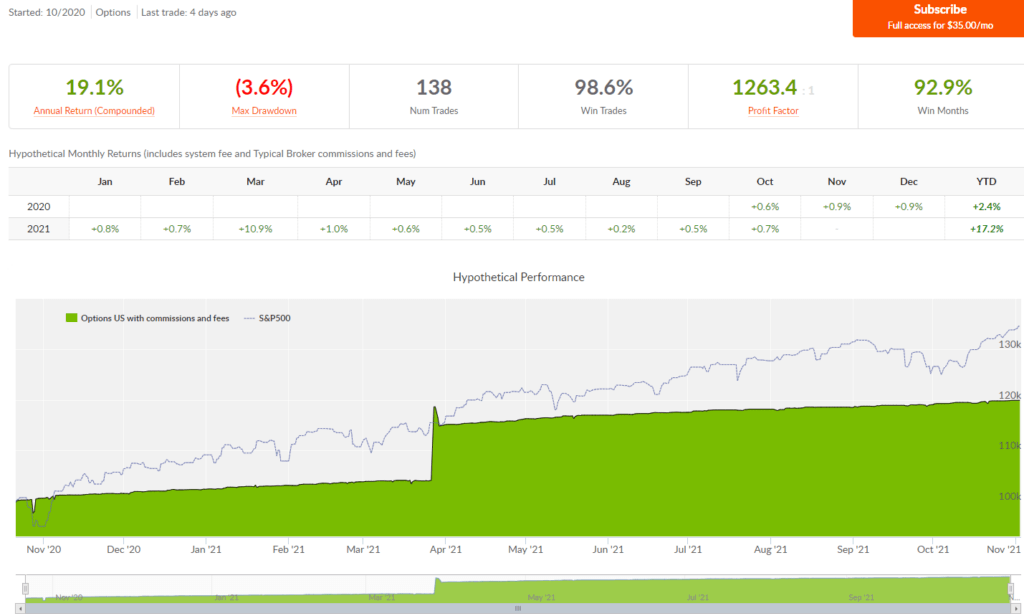

Now let’s see if this rule holds true for C2 strategies.

Profitable strategies will have a win rate superiority in over the win rate of random trades, considering the same Profit/Loss ratio, losing ones will lag accordingly. Given the probabilistic nature of the market, this superiority or lag should not deviate much from the model. With an increase in the trades quantity, the fluctuation amplitude should become smaller. It is very difficult to beat the market at a distance.

For each strategy was calculated Profit/Loss ratio, and then counted difference between the actual win rate of the strategy and the win rate of random entries got with this Profit/Loss ratio.

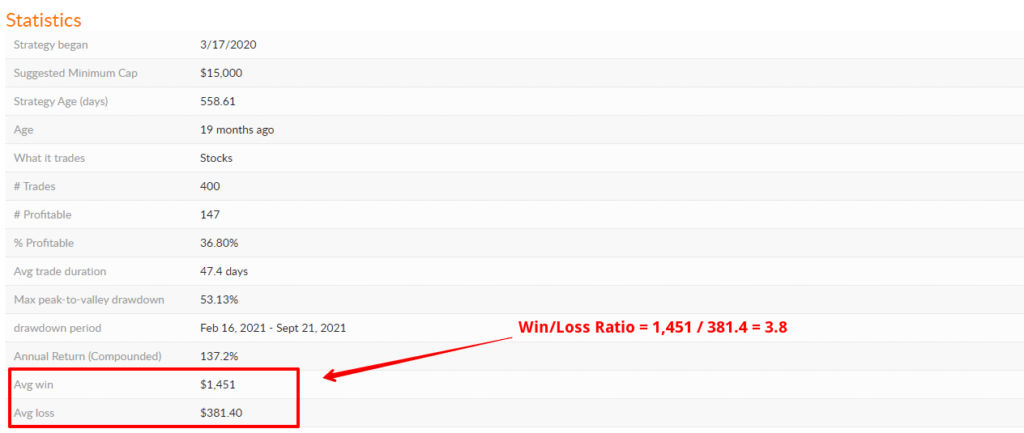

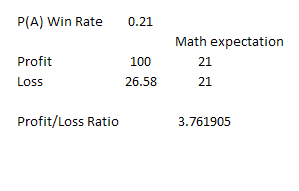

Example

Profit/Loss Ratio = 3.8

% Profitable = 36.8

With a mathematical expectation of 0 (random entries), with a Profit/Loss Ratio 3.8, the expected win rate is 21%.

Therefore, the superiority of the strategy is 36.8 - 21 = 15.8%

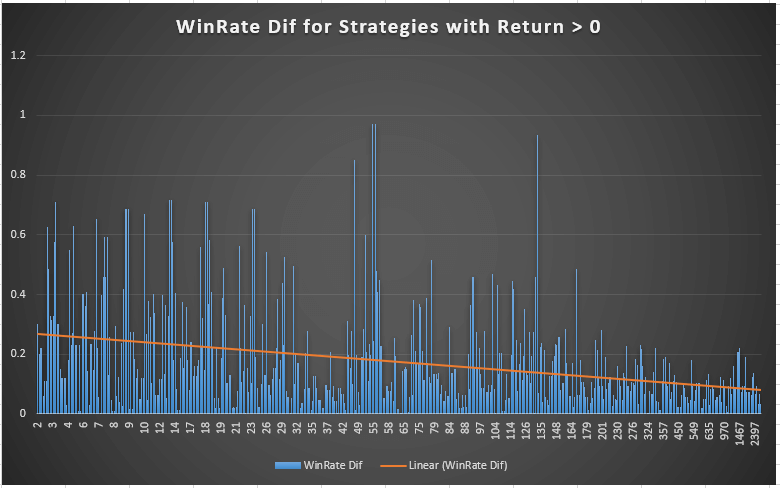

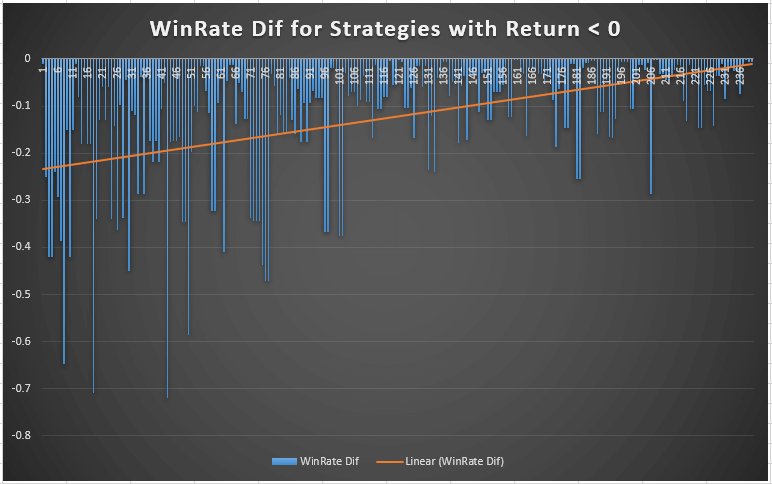

The results of the “superiority” of C2 strategies in comparison with random entries.

The chart is based on data from the grid table on 24 Sep 2021.

X-axis – all strategies sorted by the trades quantity.

Y-axis is the superiority of each strategy.

C2 strategies with positive mathematical expectation:

C2 strategies with negative mathematical expectation

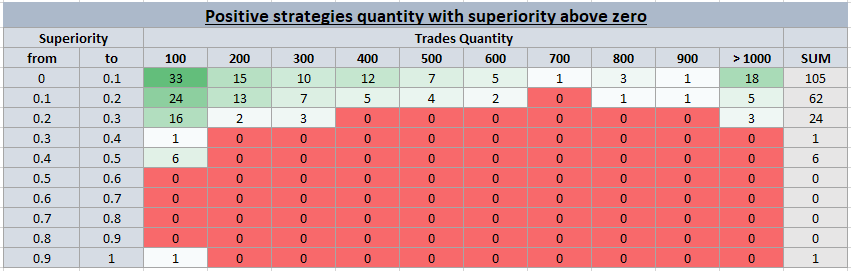

Summary table of the strategies quantity that have an superiority over random entries, depending on the trades quantity (100, 200, 300 ...):

The more data (trades), the less pronounced superiority.

In the table you can see 1 strategy with over 100 trades and a superiority between 0.9 and 1.

Let’s inspect it:

https://collective2.com/details/131825719

A win rate of 97.8% corresponds to a Profit/Loss Ratio of 0.02, or the expected loss on a trade is 49 times the profit.

This is trading without stops.

Specifically, in this case, the sale of uncovered options. In this strategy, a losing trade just hasn’t happened yet.

Conclusion

On the one hand, the conclusion suggests itself that evaluating trading strategies at a win rate requires more data. But more trades mean high costs and deterioration of the mathematical expectation, so you cannot get them cheap quickly. It often takes years to collect enough trades for such a conclusion, while many good strategies will pass you by.

On the other hand, what is the value of this conclusion? Find out post-factum that the strategy had a positive mathematical expectation?

In my opinion, the win rate only reflects the trading style. Trading can be equally profitable with a win rate of 10% or 90%, and unprofitable with a win rate of 99%.

“Win rate depends on the ratio of the average winning trade to the average losing trade.”

For example, the lower its value, the less risk per trade, and all the profit is generated by rare well-profitable trades. Trending strategies are just like that.

A win rate of 40 – 60% can often be seen on momentum trading strategies.

70 – 80% are breakouts and counter-trend trading.

90% + is buy and hold, averaging, with conditional or no stops.

This is not a rule, but only examples. There can be counter-trend trading with a win rate of 20% and trend trading with a 50%

Thank you for your attention.