Where are the big, fat, lazy industries we’re trying to disrupt?

I’d like to tell you exactly what my company does. But I can’t. So don’t ask.

When Americans are children, they learn how business works. You advertise a product. People see your ad, decide the product interests them, and pay you. Win-win: your customer gets a product she actually wants; your business earns income, fair-and-square, enough to let it continue to offer the product to still more people who value it.

That’s how it’s supposed to work, anyway. But what if you’re not allowed to advertise? Or not allowed to talk about what your product actually does?

This is the case in certain industries which society has deemed offensive or troubling. These industries include: cigarettes, gambling, payday loans, and… financial services.

Collective2 is a financial-services company. We cater to people who want to try to beat the market. The reality is that most people can’t beat the market, not consistently. Indeed, most people who try to beat the market will lose money.

There, I said it. And if what I said is true — and I openly proclaim that it is! — perhaps the restrictions on advertising financial services make sense. After all, if most people lose money most of the time when they speculate, why encourage them to do it? There must be something unsavory going on, right?

If no one can really beat the market consistently, then there’s a case to be made that most people should just buy an index fund or ETF, and call it a day. That is, instead of trying to decide which specific stocks or futures will beat the market, buy the whole market instead. You won’t do better than the market as a whole, but you won’t do worse than it, either.

That’s the argument behind indexing, and the raison d’etre for companies like Vanguard, who pioneered the field.

But still, there’s a whole set of people in the world that want to try to beat “the market.” And there are people who think they are good at it. This is the reason why hedge funds, commodity trading advisors, and private equity firms exist: because someone, somewhere, wants to try to beat the market with some of his money.

And this is the reason Collective2 exists. No one at Collective2 thinks you should take all of your money and use it to try to beat the market. That would be insane. Rather, we believe that some people — people with money they can afford to lose — should take some of their money, a small sliver, and try to outperform the market. Read that carefully: a small sliver. Of money you can afford to lose. Because you probably will.

It’s not exactly a far-fetched idea. Nassim Taleb, the author of the The Black Swan, famously proposes that people ought to follow a “barbell strategy” when investing — that is, put most of their assets in ultra-safe investments, and a small portion into extremely risky, and sometimes exotic, investments.

That’s Collective2: we’re in the right-side of the barbell; we’re a service that sells exotic, unusual risk with low probabilities of good outcomes. We’re not meant as a place to invest your child’s college-tuition money, or your retirement savings. But we are a product that a rational person might choose to use in moderation.

The problem is that companies like Collective2 are not allowed to advertise, not in the way most companies can.

What is Collective2’s product, described in simple terms? It is the possibility of market-beating returns. Not the likelihood of market-beating returns. The possibility of them. But financial firms are not allowed to describe market-beating returns.

Indeed, financial firms like Collective2 aren’t really allowed to advertise potential returns in any meaningful way whatsoever.

Okay, well, forget about numbers, then. Forget about returns and percentages.

What about real-life people using your product? What about advertising by using testimonials?

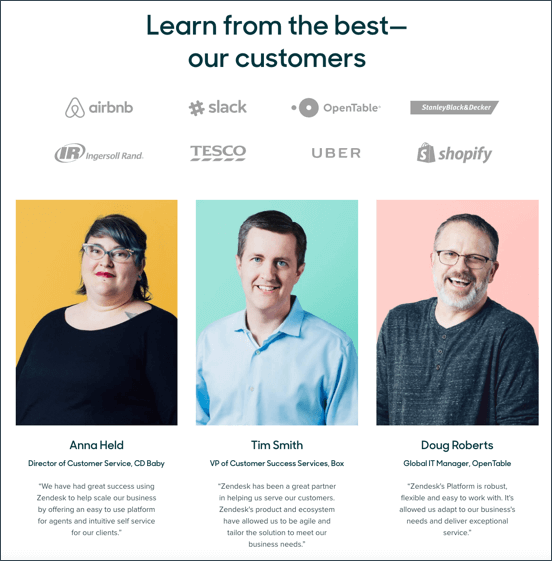

Testimonials are the go-to marketing strategy for internet and software companies. You’ve probably seen a hundred of these in the past month — a photograph of some bland-looking guy on a web site, with a caption that says: “John Doe over at Company X uses our product, and he loves it. It has increased his blah-blah productivity by blah-blah percent.”

Zendesk is not a financial-services company. They are allowed to use testimonials from actual customers.

Testimonials are great marketing because they crystallize in a customer’s mind how your product is used in real life, and what its real benefits are.

Human beings are natural storytellers. It’s one thing to present a dry data-sheet about a product, listing its features and performance, but most people’s eyes glaze over when reading something like this. Stories, on the other hand, about real people doing real things — now, that’s interesting. Stories are something humans enjoy and understand.

Except, it’s not allowed.

Not for financial-service companies, anyway. Every sector in the financial space has its own regulator, with its own arcane regulations, but generally speaking, “testimonials” from investors are verboten.

You notice a pattern here? The most effective types of marketing (saying what the product is, using testimonials to describe how a product is used) are forbidden. It’s almost as if someone, somewhere, wants to make it hard for small financial service companies to gain customers.

This is the part of the article where I’m supposed to explain how Collective2 overcame these hurdles, and figured out how to attract new customers despite restrictions on many forms of traditional advertising.

Alas, I can’t do that, because we haven’t. The truth is, we have no idea how to attract new customers without describing what our company really does, or without using testimonials, or without describing the (Small! Unlikely!) possibility of good returns.

So we muddle along, trying to follow both the letter and spirit of regulations*, while also introducing our company to new customers. On search engines, we market “against” larger competitors (the idea here is that customers already understand what these large, established companies do, so we can latch on to people’s interest in those firms to attract new customers to ours). We write blog posts (like this one) which we hope are interesting enough to motivate people to do the work of finding our web site (collective2.com), and figuring out what the hell we do. We sponsor podcasts.

This week we’re trying a new marketing strategy. We’re releasing a marketing-ish video that kinda, sorta, but not really, describes Collective2. We use music and vague images that are meant to convey feelings and concepts (Collective2 is fun and exciting; our larger competitors are slow and boring). The video isn’t likely to win a Clio anytime soon (it was constructed out of stock footage), but, you know, it’s something new, and so we’ll give it a whirl.

If you’ve read this far, I have a favor to ask. If you find the video below Not Too Terrible, please share it on your Facebook, Twitter, or LinkedIn page (click the little arrow icon near the bottom-right the video). If you add a hashtag #roboro, we’ll be able to find your share. We’ll pick a winner at random and award a free month of Collective2 service, or a snazzy Collective2 tee-shirt. Just share the video with the #roboro hashtag to be included in the prize pool. It’s our scrappy attempt to get the word out about our pugnacious little startup, which isn’t allowed to market through traditional means.

If you like C2, please help. Here’s the video. Please share on your social media:

Regulations are never created out of the blue, randomly, by mean people. They are created with good intentions, by good people… usually after a bad actor does something dumb or evil. I want to be clear that I am not criticizing regulators or regulations in general. Indeed, the people I have met over the years who regulate Collective2 have always operated with professionalism and courtesy, and they act out of what they consider the best interests of industry and society as a whole. So if it sounds like I am whining about the unfairness of it all… well, I am, sort of; but I also understand that regulation is essential to maintaining public trust in markets, and to preventing a race to the bottom among industry participants.